Pennie and the American Rescue Plan

The American Rescue Plan (ARP) was signed into law by President Biden on March 11, 2021. The purpose of the ARP is to increase the amount of financial assistance available to customers of the state-based marketplace, Pennie. The additional assistance lowers health insurance premiums for new and existing Pennie customers in 2021 and 2022. Customers who already receive financial assistance, such as advance premium tax credits (APTC), to lower the cost of health coverage, will be eligible for additional financial assistance to reduce the cost of coverage even further. Pennie has moved quickly to implement these changes.

Pennie has a two-phase approach to implement the American Rescue Plan. Phase one, which began at the end of April, includes updates to the online Pennie application allowing customers (including those eligible for unemployment compensation) to access the enhanced subsidies. Phase two begins at the end of May/beginning of June. This phase will focus on eligibility redeterminations for current customers to automatically update their plans with enhanced subsidies.

PHLP has answered some frequently asked questions regarding Pennie and the American Rescue Plan.

Q. What type of financial assistance will be available?

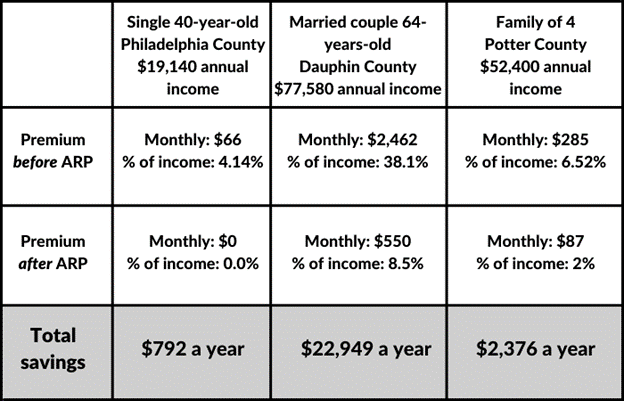

A: If you were previously eligible for financial assistance, like advance premium tax credits (APTC), to lower the cost of health coverage, you will be eligible for additional financial assistance to further reduce the cost of coverage. If you previously did not qualify for financial assistance because your income was too high, you will now qualify and might receive assistance because the American Rescue Plan caps premiums at no more than 8.5% of household income including enrollees with household income above 400% of the poverty level.

Our colleagues at the Pennsylvania Health Access Network (PHAN) shared examples of how the American Rescue Plan affects healthcare costs through Pennie:

Q. What if an individual’s income changes while the American Rescue Plan is in effect?

A: Your monthly premium is based on the income you report to Pennie. If your income goes down, you may qualify for lower monthly premiums. If your income goes up, your monthly premium may go up. As stated above, Pennie customers will not pay more than 8.5% of their annual income on health insurance premiums.

Q. How long will an individual’s premiums remain lower due to American Rescue Plan?

A: The additional premium subsidies are available for all of calendar years 2021 and 2022 but would no longer be available as of 2023 unless additional legislation is enacted to extend them. Pennie customers are eligible for the benefits under this law from the date in which their coverage through Pennie began.

Q. Do individuals have to enroll in a specific plan to get lower premiums under the American Rescue Plan?

A: No. A Pennie customer can enroll in any plan – bronze, silver, or gold – and apply the amount of advance premium tax credits (APTC) they qualify for to the plan of their choice. The American Rescue Plan calculates the amount of reduction using the cost of the Pennie benchmark plan, your income, and your age to determine how much APTC you qualify for.

Q. Do individuals still have to pay my full April premium despite possible changes under the American Rescue Plan?

A: Yes. A Pennie customer should continue to pay their premiums as normal. New and current customers may not see the new benefits on their account dashboard right away and will have to pay their April premium based on their eligibility under the old rules. Pennie customers will be eligible for the new benefits from their first day of coverage and will start to see those benefits in their accounts when the updates required under the law are made.

Q. If a Pennie customer is in the U.S. on a visa and does not qualify for Medicaid coverage because of their visa status, will their premiums for private health insurance go down?

A: Yes. Depending on one’s income, their premiums may be as low as $2/month. The American Rescue Plan includes visa holders who do not qualify for Medicaid coverage.

Q. If an individual did not apply for coverage during Pennie’s initial open enrollment period but wants to see if they are eligible for financial assistance under the American Rescue Plan, can they still apply for coverage through Pennie and get financial assistance?

A: Yes. Due to the overwhelming impact of COVID-19, Pennie has made enrollment possible for all eligible Pennsylvanians. The COVID-19 Enrollment Period opened February 15th for any Pennsylvanians who need health coverage and runs through August 15th. Whether you are new to Pennie, or you are already enrolled in coverage through Pennie, you can use the COVID-19 Enrollment Period to ensure you have the coverage you need.

Remember: You do not have to test positive for COVID-19 to be eligible for Pennie’s COVID-19 Enrollment Period. Your medical history involving COVID-19 is not a factor at all. Pennie’s COVID-19 Enrollment Period is named as such because it is an opportunity for Pennsylvanians to get the health coverage they need during the COVID-19 pandemic. Everyone, regardless of testing positive for COVID-19 or not, has been affected by the global pandemic. This is a chance for all Pennsylvanians to access quality health coverage so that they can better protect themselves and their families.

You can find more information on Pennie’s website.